As someone looking to buy a home, it’s vital to consider taxes carefully when making your purchase. This helps you plan your finances effectively and get the most out of your investment in the long run. These taxes also play a pivotal role in the local government’s budget allocation for public projects, programs, and funding.

We aim to provide clarity on what you’ll be investing your hard-earned money into. By the end of this article, we aim for you to have a better understanding of how property taxes work, particularly focusing on Pinellas County property taxes.

Understanding Pinellas County Property Taxes

Credit Image by Todd Howard | Source

Property taxes can seem overwhelming, especially when you think about dealing with taxes or government regulations.

What Properties are Taxed in Pinellas County?

In Pinellas County, two types of property are subject to taxation: real estate properties and tangible personal property.

Real estate property taxes apply to land, buildings, and land improvements, while tangible personal property tax pertains to equipment and furnishings within commercial buildings and rental homes.

What is Pinellas County’s Tax Rate?

For 2024, the property tax rate in Pinellas County is approximately $4.7398 per $1,000 assessed value. Keep in mind that the rate varies on several factors, including the specific area within the County and any additional taxes levied by local municipalities or special districts.

For every $1,000 of the assessed property value, one mill equates to $1 in property tax. This is how taxing authorities calculate your property tax bill. Each year, this calculation is outlined on your TRIM (Truth in Millage) notice.

The TRIM notice gives you an estimated value of your property, lists all the taxing authorities, and provides an overall total estimate of property taxes.

However, it only covers 26% of your property tax bill, representing the millage rate set by the County. Any adjustments made to the County’s millage rate only impact the portion of your tax payment that originates from the County.

Dates to Remember

- Property tax notices for the year are mailed by November 1st.

- You can pay your property tax bill from November 1st until March 31st.

- Unpaid property taxes by April 1st will be labeled as delinquent.

Paying your tax earlier can lead to certain reductions permitted by Florida law, so it’s advisable to avoid paying until April to protect yourself and your property from potential future troubles.

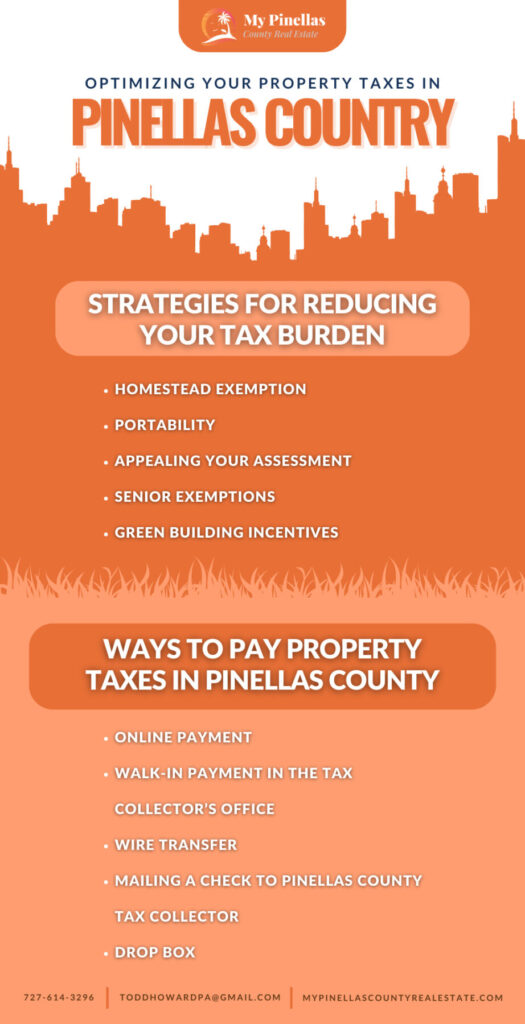

Strategies for Reducing Your Tax Burden

Credit Image by Todd Howard | Source

As a property owner, you have an opportunity to lessen your tax obligations by taking advantage of Pinellas County Property Tax Exemptions. These exemptions and incentives can alleviate both financial strain and mental stress.

Eligible individuals, including seniors, veterans, active duty military personnel, and homeowners with disabilities, can benefit from these exemptions.

Homestead Exemption

- The homestead exemption, mandated by the constitution, offers a $50,000 reduction in the assessed value of a property. Eligible applicants must have beneficial or legal rights to real estate.

- To qualify, individuals must be legitimate Florida residents residing in the property as their primary residence as of January 1st of the tax year. The initial $25,000 exemption is automatic. The additional $25,000 applies to properties valued between $50,000 and $75,000, excluding school taxes.

- The application deadline is March 1st annually. If you’ve purchased a new property, you must apply immediately.

Portability

- Recent legislation in Florida allows citizens to transfer the accrued property tax benefits from the assessed value of their previous home to their new home. This can lead to substantial annual property tax savings and a reduction of up to $500,000 in the taxable valuation of the new home.

- Applications for portability must be submitted by March 1st.

Appealing Your Assessment

- You may appeal your assessment if you are unhappy with your property tax bill. You may do this by checking out the tax collector’s website. Make sure that your appeal is backed up by evidence. If you are successful in your appeal of your property assessment, your tax liability may be reduced significantly.

Senior Exemptions

Credit: Image by Simon Godfrey | Unsplash

Low-Income Seniors

To qualify, the homeowner must meet the following criteria:

- At least one homeowner must be 65 years old or older as of January 1st of the application year.

- The applicant is either eligible for the homestead exemption or is currently receiving it.

- The total household income from the previous year must not exceed the adjusted income limit for 2024, which is $36,614.

- The application must be submitted from a tax district where the exemption is available.

These requirements align with the annual changes mandated by the Florida Department of Revenue.

Low-Income Seniors (65+), 25-Year Residency

If the property is valued at less than $250,000, and the owner meets the following criteria:

- They have lived in the property as their primary residence for at least 25 years

- They are 65 years of age or older, and their household income does not exceed the threshold set by the Florida Department of Revenue for the economically disadvantaged senior exemption.

Veteran (65+) with Combat-Related Disability or their Surviving Spouse (Property Tax Benefit)

- You have a homestead exemption.

- You are 65 years old or older.

- You suffer from a permanent, partial, or other disability related to combat.

- You have been granted an honorable discharge.

The entire exemption may be carried on by the surviving spouse if:

- The veteran precedes their spouse in death.

- The surviving spouse lives permanently on the homestead property and has legal or beneficial ownership.

- The survivor doesn’t get married again

Green Building Incentives

There are numerous advantages to renewable energy and energy efficiency, including tax credits where the tax you owe will be reduced.

There is no harm in applying to these programs if you qualify. No matter how high or low you will benefit from these, the important thing is they will help you lessen the load you carry.

Navigating the Property Tax Payment Process

Credit Image by Todd Howard | Source

Today, there are various methods available for paying your property tax. Regardless of your chosen payment method, it is crucial to ensure that your taxes are paid on time.

| MODE OF PAYMENT | DESCRIPTION |

|---|---|

| Online Payment | Online payment lets you pay from your bank account without any transaction fee (eCheck). However, delinquent property taxes are not permitted to use this option. You can also pay through your credit or debit card, with a convenience fee of 2.95% of the transaction amount, with a minimum of $2.50. |

| Walk-in Payment in the Tax Collector’s Office | This payment option does not require any appointments. You can pay in any of their offices. |

| Wire Transfer | Click this to access their instruction if you opt for a wire transfer. |

| Mailing a Check to Pinellas County Tax Collector | Make the check payable to this details:

Visit their website for more information. The same envelope must be used to send multiple checks. If the office needs to contact you, write your phone and account numbers on the memo line of your check. Verify that the amount on the handwritten line corresponds to the amount in numbers. Remember to sign. |

| Drop Box | Place your money safely in one of the drop boxes the Pinellas County Tax Collector Office has set up outside their several tax collector offices. |

Pinellas County tax payment is more accessible now since it is not limited to walk-ins anymore. Remember that once you pay, you pay in full unless you are in an installment or partial payment plan.

Conclusion

Now that you know how Pinellas County property taxes work, you’re in a better position to prepare your taxes smartly. Remember to make savvy decisions and take full advantage of the opportunities that come your way!

For more details about the property taxes or if you are interested in looking for homes for sale in Pinellas County, FL, you may book an appointment with me by calling 727-614-3296 or emailing toddhowardpa@gmail.com.

You can also reach us through the following social media channels:

Credit Image by Todd Howard | Source

Frequently Asked Questions

What happens if I fail to pay my property taxes on time?

Two years following the date of delinquency, a tax deed may be applied for if taxes are still outstanding. The Circuit Court Clerk may sell the property at public auction if the owner doesn’t pay the obligation.

How can I verify the accuracy of my property tax bill?

Here are ways to verify your property tax bill:

- You can go to the collector’s office or contact the county auditor.

- You can do your computation online using property tax calculators.

- You may appeal for your assessment if you are not satisfied with your tax bill.

How often are property taxes assessed in Pinellas County?

Every year, on January 1st, the Pinellas County Property Appraiser Officer (PCPAO) is responsible for assessing the value of every property located within Pinellas County.

Are there any exemptions available for veterans in Pinellas County?

Yes! Veterans with honorable discharges and surviving spouses with disabilities from their service are eligible for Pinellas County real estate tax exemptions.

Can I pay my property taxes in installments?

Yes. To be eligible for the installment payment plan, your estimated taxes must be higher than $100 for each tax notice. Applications for the Installment Payment Plan 2024 can be submitted from November 1st, 2023, until April 30th, 2024.